Are you tired of low yields and interest rates in traditional asset classes like stocks and bonds? If so, it might be time to consider investing in music royalties and media assets.

Not only is the entertainment industry one of the most desirable industries for people, but music royalties are also an increasingly attractive asset class due to their low correlation with macroeconomic performance and high-income potential from royalties.

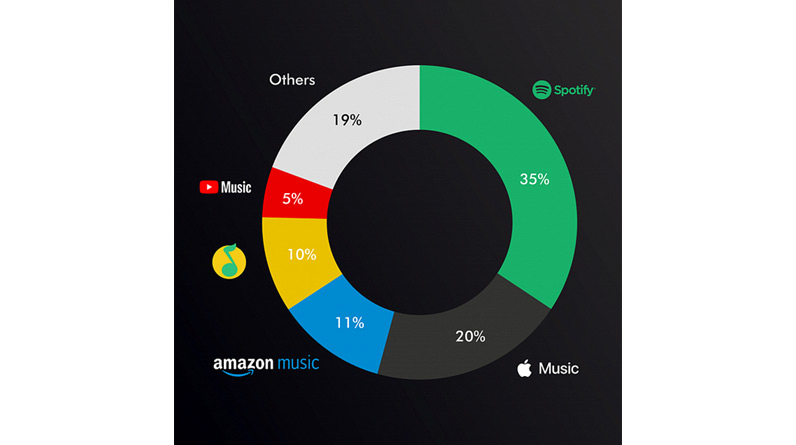

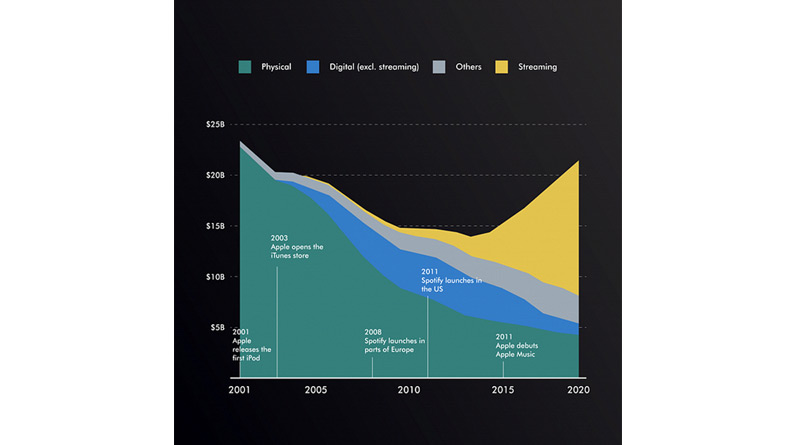

Streaming platforms like Apple Music and Spotify have revolutionized the music industry, driving the growth of music revenues after 15 years of decline caused by piracy and the decline of CDs. This is good news for investors looking to own music assets and the royalties generated by them. At a song level, new music royalty income generally peaks 3 to 12 months after release. Income then declines over the next 5 to 10 years. At this point, the remaining “tail” of income often bounces around, but remains relatively stable thereafter.

Investors can also consider media assets like stock videos with high shelf life. Generic video snippets like helicopters flying, bomb blasts, and cityscapes are purchased by film production houses, as it’s cheaper than shooting. Collections of beats, classic 90s hip hop songs, and popular albums can also provide a solid return on investment. Of course, music assets are subject to change in trends and consumer tastes. However, they benefit from artist or genre loyalty. Cultural trends can change abruptly, but consumer spending on music is completely separate from general spending.

Music royalties can be a lucrative investment opportunity for those looking to diversify their portfolio. In recent years, music royalty investments have gained popularity among investors seeking alternative sources of income. Axba, a leading investment firm, has developed an innovative investment approach to music royalties that offers a range of benefits to investors. In this beginner’s guide, we will explore Axba’s investment approach to music royalties.

What are Music Royalties?

Music royalties are payments made to songwriters, composers, and performers for the use of their music. These payments are made by music streaming services, radio stations, TV shows, and other media outlets. Royalties are typically paid on a per-play basis or as a percentage of revenue generated by the use of the music. There are two main types of music royalties: mechanical royalties and performance royalties.

Mechanical royalties are paid to songwriters and music publishers for the use of their music in physical or digital format. This includes CDs, digital downloads, and streaming services. Performance royalties, on the other hand, are paid to the songwriter, composer, and performer for the use of their music in live performances, radio broadcasts, and TV shows.

Axba’s Investment Approach to Music Royalties

Axba has developed an innovative investment approach to music royalties that offers a range of benefits to investors. The firm specializes in acquiring and managing music catalogs that generate steady income streams from music royalties. The investment approach involves acquiring music catalogs with a proven track record of generating consistent royalty income. These catalogs are typically made up of music from established artists with a strong following.

Axba invests in trendy and retro music which can be popularized once again, as well as media assets with high shelf life. Past performance shows that music spending has historically had little correlation to broader economic activity and financial markets. Viewership on streaming platforms is predictable and such platforms use a lot of analytics to forecast viewership and subsequent cash flow. Music has no boundaries. Popular music apps are global businesses and song tracks are available to consumers all over the world. Apart from large market size, it also has reduced cultural and behavioral risk. Amortization of intangibles like intellectual property is governed primarily by section 197 of the Internal Revenue Code. Music investments can be amortized to reduce taxability and generate higher net returns.

The company invests in music albums, single songs and collections of tracks that earn consistent royalties. They like to invest in undervalued retro soundtracks since they may gain popularity once again. They also invest in media assets such as stock videos, beats, even lyrics and dialogues. The company invests in these assets with the goal of selling them for higher prices.

Investing in Music Royalties

Investing in music royalties can be an attractive alternative investment for those looking to diversify their portfolio. Music royalties offer a unique combination of steady income and potential for growth. However, it’s important to understand the risks involved in investing in music royalties. Like any investment, there is no guarantee of returns and investors should be prepared to hold their investment for a long period of time.

Axba’s investment approach to music royalties offers several benefits to investors. The firm has a proven track record of success in acquiring and managing music catalogs that generate steady income streams. Axba’s team of experts works closely with the artist’s team to maximize the value of the catalog and expand their fan base. This approach has resulted in consistent returns for investors.

Conclusion

Investing in music royalties can be a lucrative opportunity for those looking to diversify their portfolio. Axba’s investment approach to music royalties offers a unique combination of steady income and potential for growth. The firm specializes in acquiring and managing music catalogs that generate consistent royalty income. Investors should carefully consider the risks involved in investing in music royalties and seek professional advice before making any investment decisions. With the right approach, investing in music royalties can be a rewarding experience for investors.